Managing your O2C process when employees are absent

You’ve probably designed your team to manage a certain number of invoices or remittances in one day. That’s why an absence, especially an unplanned one, can cause delays that affect your customers and your brand.

But whatever the reason you’re missing a team member, the work must still get done. So what can you do?

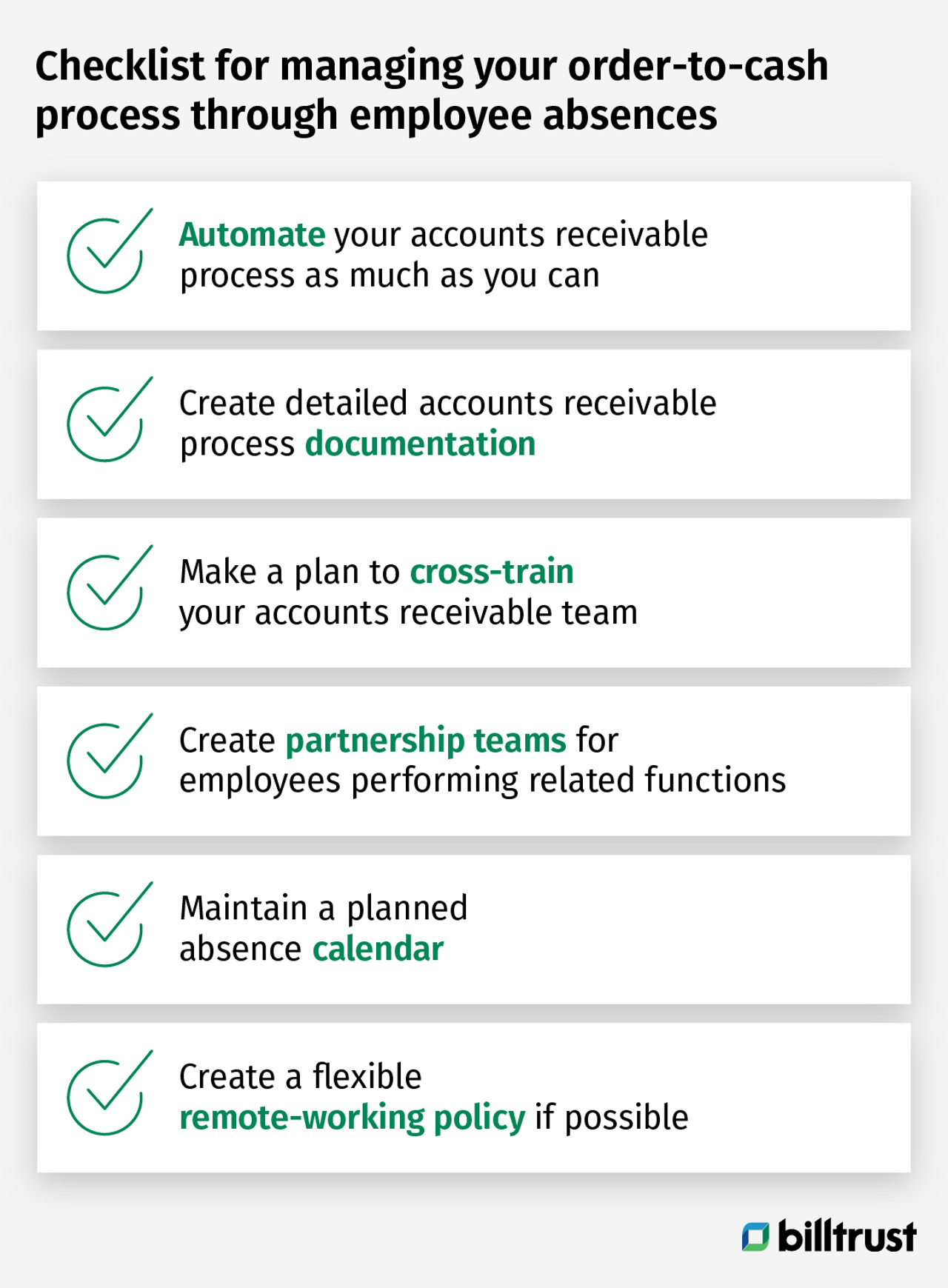

Automate your accounts receivable process as much as you can

The best solution to human absences is to move humans off repetitive tasks and onto activities that contribute toward strengthening customer relationships or strategy development. From credit scoring to account collections, there are ample opportunities to automate your order-to-cash (O2C) cycle. Good candidates for automation are processes which are both:

- Time consuming

- Repetitive

and:

- Have high potential for error

- Include multiple systems that use the same data

Credit risk management

Artificial intelligence (AI) and machine learning have improved the speed and accuracy of credit risk management, allowing credit decisions to render faster than ever. Online credit applications reduce keying errors in applications and allow suppliers and their customers to see how the application is progressing.

Invoicing and eInvoicing

Electronic invoicing presentment and payment (EIPP) tools send invoices to customers via email or through a payment portal. The customer plugs in their payment information and the payment and remittance information are transmitted back to the supplier for cash application.

Cash application and remittance matching

Manually performing two- or three-way matches for every check you receive is exactly the kind of repetitive task your team will thank you for automating. Most matches are straightforward, requiring the employee to locate and confirm a received payment is matched to its correct invoice (in the case of two-way matching) or locating and matching a received payment to its invoice and remittance data (in the case of three-way matching). When you automate cash application with match rates close to 100 percent, your accounts receivable team can focus on invoices that need human intervention to match correctly.

Automated cash application has the additional advantage that once the payment is applied, the corresponding credit is released for the customer to purchase more supplies and keep the wheels of everyone’s business turning.

In the last couple of years, virtual credit card use has become popular for B2B companies looking to increase their payment security. Unfortunately, single-authorization cards can cause havoc for accounts receivable teams if the single-authorization card number doesn’t automatically update on the customer’s account.

Simply put, a new card number for every payment can look a lot like a new payment card on the account, adding a level of complexity to matching the payment with the customer. The good news? Cash application automation can help overcome this new challenge, and the built-in security of virtual credit cards is a big bonus for AR teams who are working remotely.

Some customers might want to pay by electronic check or automated clearing house (ACH) transfer. ACH transfers simply mean the money is transferred from one account to another via ACH, which is the process banks use to “talk” to each other to confirm enough funds are available in the customer’s account and transfer them to the supplier’s account. Advanced ACH payments come with remittance data and easy autopay implementation -- which means cash application is also easier.

B2B collections

Employee absence in the order-to-cash (O2C) process may mean delayed application of payments on a customer’s account. Without smart collections tools to reduce delinquencies, when the receivable management collections team runs its report for late payments to follow up on, accounts where a payment has been sent but hasn’t been applied might show up as a late payment.

If your collections professionals don’t follow up on missing payments immediately, the effect of that is an uptick in days sales outstanding. But how can they confidently follow up if the customer’s payment is awaiting processing? Manual processing is like playing whack-a-mole: the steps you take to beat one problem pop another problem up somewhere else.

Automated payments and cash application mean almost every payment is applied to the correct invoice in a matter of hours, not days. With that advantage, collections teams can be sure their recovery efforts are focused on payments that are really missing instead of in-process.

Create detailed process documentation

Whether you plan to automate some or all of your O2C process, mapping it out and providing step-by-step instructions for every part of the process is an accounts receivable best practice. Having process documentation anyone can refer to and perform the tasks required means someone in your team should be able to follow the instructions and keep the AR workflow moving.

Make a plan to cross-train your accounts receivable team

While specialization is definitely a requirement for automated processes, humans thrive on variety to keep our brains engaged. Workers who have a holistic understanding of the process they’re part of tend to feel more engaged.

Rotating your team through different accounts receivable functions allows them to experience and learn about the whole process, and gives them some knowledge to allow them to cover for colleagues who are taking a personal day or who’ve headed out for a well-earned vacation.

Create partnership teams for employees performing related functions

Create a buddy system by pairing team members or putting them in small groups so each team member is a specialist for more than one task. That way, in case of an absence or vacation, there are at least one or two employees who can do the job of the absent team member, handle correspondence and cover the work during an absence.

Maintain a planned absence calendar

This might sound a little obvious, but you’d be surprised how many teams lack a shared paid time off (PTO) calendar. Shared calendars for tracking planned absences offer important benefits:

- Prevent too many people booking the same day off, leaving the team short-handed

- Allow managers to proactively change assignments to cover absences

- Allow project deadlines to be planned around employee coverage (and vice versa)

- Provide transparency around PTO

And, as much as anything, a shared PTO calendar helps managers track who they should expect to see in the office and / or online.

Finally, everyone needs time away from the office to rest and recharge because work can be stressful. By seeing which employees are planning their time away from their laptop, managers can monitor which team members are overdue for a break.

Create a flexible remote-working policy if possible

Since the early days of the coronavirus pandemic, remote working has been a reality for many accounts receivable professionals. But whether the world will return to its pre-pandemic in-office requirements remains to be seen, developing a flexible remote-working policy can be a big help for other situations.

Imagine a parent who calls out because their child is sick. The parent may well be able to work, but a lack of clarity around working from home means the parent takes a personal day and the team’s productivity takes a hit. This could be avoided, and work uninterrupted, if employees know that there’s a policy and infrastructure in place to allow them to work from home.

Additionally, there are numerous benefits from offering flexible work-from-home policies, but there are reasons employers should encourage it – not least of which is when your team doesn’t need to come to the office, you can hire the best talent regardless of where it’s located.

Of course, there may be security issues to work around – not many customers would be happy to have their credit card or banking information in an unsecured location. Some software may need a virtual private network (VPN) to operate outside the office, but these are problems that can be overcome with a remote-working policy and guidelines around what work can be carried out off-site.

See how automation can help your team

Want to schedule a no-stress call with an AR automation expert to see how automation can help your team? Fill out the form and we'll get back to you ASAP!